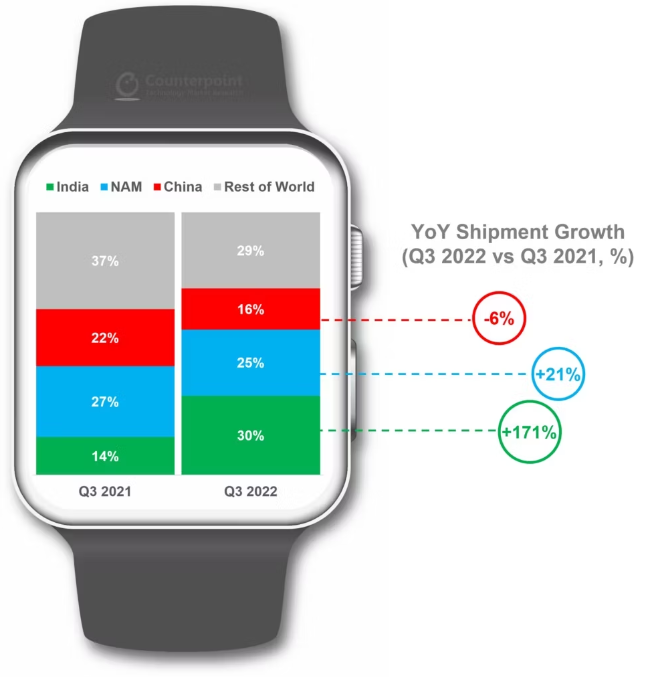

This is obvious from quarterly shipping numbers given by market research firms like Counterpoint. The firm’s most recent research, covering the third quarter of 2022, shows dip in the area as well as other wearables that are less expensive than full-fledged smartwatches. However, it appears that this decline in sales has come at the price of Samsung, which had less-than-pleasant summer results. More precisely, the Asian smartwatch market increased by 171% year on year, making it the largest market in the world. According to the Counterpoint Global Smartwatch Model Tracker, several significant emerging markets rose in the third quarter, although none of them were in China or Europe.

During the reporting period, Samsung debuted the Galaxy Watch5 series, exhibiting a 62% quarterly increase and boosting its share of the HLOS market by 5% over the previous quarter. Even in the fourth quarter of 2021, Samsung increased shipments by just 6%, causing it to lose momentum in Asia. It dropped below 33%. Korea kept second position in the worldwide market, lowering its share by 27% every year, and the distance between the Indian noise and the third-placed machine is narrowing. Shipments of smartwatches with higher-level operating systems (HLOS) such as Google Wear and Apple watchOS increased by 23.9% year on year. Although sales from HLOS devices is about 10 times larger than revenue from budget-sector devices due to the higher average selling price (ASP), the industry is expanding toward lower basic versions. The Apple Watch 8 wristwatch, which was debuted in September, helped the American corporation raise its sales by 48% year over year. The newest version carried 56% of the entire load.